Liberals, NDP pass bill to enact 2-month GST holiday in House of Commons

The House of Commons has passed legislation that will remove the federal sale tax for two months from a range of items, including childrens’ toys, books, restaurant meals and takeout, as well as beer and wine.

As expected, the NDP helped the minority Liberals push the exemption through Thursday night.

The Conservatives voted against the bill, calling the measure a “temporary two-month tax trick,” as did the Bloc Québécois.

The bill, which the Liberals and NDP agreed to fast-track through the usual procedural steps, now goes to the Senate.

Once passed, the legislation will provide a GST rebate beginning Dec. 14. The tax vacation will remain in effect until Feb.15, 2025.

The Liberals originally pitched the tax holiday along with a plan to send $250 cheques to the 18.7 million people in Canada who worked in 2023 and earned $150,000 or less. But some Canadians raised concerns about being excluded from the millions who would receive those cheques.

The NDP threatened to withhold support for the entire package if the government didn’t split the promises into two pieces of legislation. The Liberals did not include the cheques measure in the bill the House of Commons passed Thursday night.

It is unclear when they might present that legislation.

NDP Leader Jagmeet Singh said in a media statement on Wednesday that his party will support the cheque measure later if the Liberals expand it to include more Canadians, “including seniors, people with disabilities and injured workers.”

Conservative Leader Pierre Poilievre called the Liberal’s proposed GST holiday a ‘temporary two-month tax trick.’

The Liberal government introduced the bill on Wednesday that would bring in a promised GST holiday starting next month. Prime Minister Justin Trudeau has billed the tax holiday as an affordability measure aimed at alleviating cost-of-living pressures.

Some economists have cautioned that the measure could have inflationary consequences later this spring.

Poilievre said the government should instead adopt his policy suggestions by scrapping the carbon tax and removing the GST from new homes sold for under $1 million.

“My tax cuts are not just about lowering costs. They’re about sparking more production,” he said.

The proposed measure would temporarily remove the GST from some goods and services — including children’s toys, beer and wine and restaurant meals.

Government House leader Karina Gould was asked by a reporter to respond to Conservative Leader Pierre Poilievre calling the Liberals’ two-month GST holiday a ‘tax trick.’ She said if Poilievre cared about the financial pressures Canadians are feeling, he would vote in favour of the proposal.

Government House leader Karina Gould called Poilievre’s stance on the tax holiday “disappointing” and “disingenuous.”

“For the people who it’s going to benefit, which is every single Canadian, it’s actually meaningful for them,” Gould told reporters Thursday.

NDP agree to pause House gridlock to pass GST bill

The NDP, which ended its governance agreement with the Liberals earlier this fall, has been calling for the GST to be taken off daily essentials permanently.

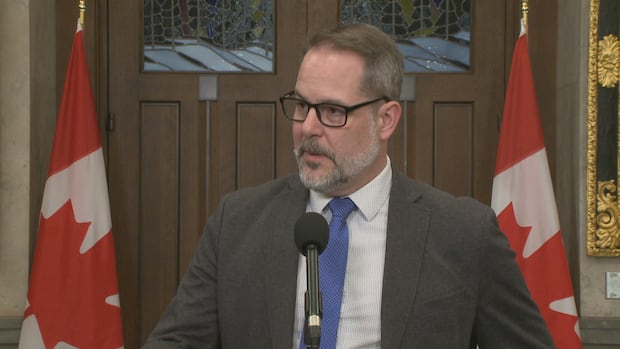

MP Alexandre Boulerice said his party was “forcing the Liberals” to put the tax holiday on the table.

“Two months is a little bit short, but that was something that we pressed. We got something that will help the middle class and workers, so of course we’re going to support it,” he told reporters on Thursday.

“We support the measure, not the Liberals.”

Quebec NDP MP Alexandre Boulerice says his party had put pressure on the Liberals to remove the GST and that, while a two-month holiday is not long enough, his party supports the measure, not the Liberal Party.

The federal government estimates that the tax holiday would cost the federal treasury an estimated $1.6 billion in foregone revenue. As it’s currently designed, the $250 cheque program would cost about $4.68 billion, a Finance official told CBC News.

The House has been unable to move forward with regular business for weeks as opposition MPs have pushed the Liberal government to release documents related to a now-defunct foundation responsible for doling out hundreds of millions of federal dollars for green technology projects.

Because the matter is considered a question of privilege, it takes precedence over all other House business. The NDP voted with the Liberals to temporarily pause the privilege debate on Thursday in order to move the GST bill through the House.